By: Paul MacDowell and Cool Trader Pro User

The Retirement Gamble, a PBS presentation (52 min.) https://greatwealthstrategies.com/education/

Let’s begin with one simple fact, America is facing a retirement crisis.

1. Half of all Americans say they can’t afford to save for retirement.

2. One third have no retirement savings at all and can never retire.

3. Although I had a retirement plan. Unfortunately I was forced to dip into it several times just trying to financially solvent. Now I no longer have a viable plan.

4. The retirement options that are presented are a mess, they aren’t a viable system.

Company managed plans

1. Plan descriptions are overwhelmingly confusing.

2. Advice is colored by those who have their commissions on the line.

3. The 401k is the only product Americans buy when they don’t even know the price of it!

4. The 401k is the only product Americans buy when they don’t even know the quality and danger of it!

5. Americans don’t know this b/c the mutual fund companies have protected themselves from regulation that would expose the price and danger of their products.

Robert Hilton Smith did his PHD on the American Retirement Crisis.

1. Fees he found hidden under the name EXP RATIO. A dozen different kinds of hidden fees: asset management fees, record management fee, trading fees, marketing fees, admin fees, loan fees. Fees are opaque

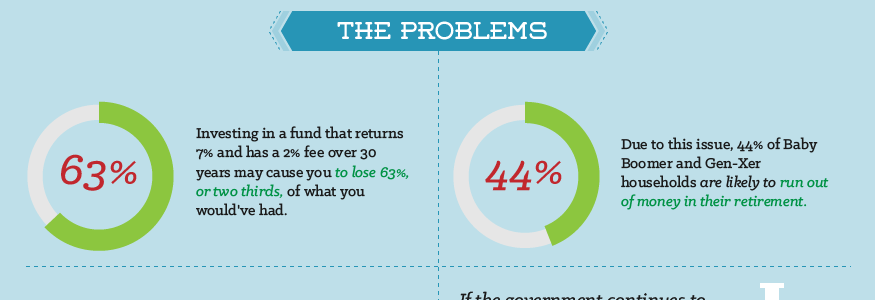

2. The prospectus says 2%-5% management fees. Some participants are paying 10 time more for the same plan. Add your fees up over 20 years and it can total 63%!

3. Jack Vogel founder of Vanguard. “If you want to maximize your retirement account make sure you minimize your broker’s take.” E.g. Assume 7% return with 2% management fee for 50 years. The difference of return between 7% gross revenue and your net 5% after fees is staggering. Your net income after fees will be about 63% less. “The magic of compounding returns are overwhelmed by the tyranny of compounding costs. It’s a mathematical fact.”

4. Do you really want to invest 100% of the capital with 100% of the risk and receive only 1/3 of the return? (21-26 min)

5. Company gross- $29,457 = $1,000 x 7% X 50 years = 61%

6. Your net – $11,467 = $1,000 X 5% X 50 years = 39%

How do mutual funds get in my 401k?

1. In order for mutual funds to get plan administrators to invest in their mutual fund the mutual funds are required to pay the brokers a legal kickback. This fee is not paid by the administrator. It is passed on to you. This is another family of fees that are added to your basic fee contract.

2. Asking the investment companies, “Couldn’t the industry do a better job of explaining the fees and their impact on the plan?” Their answer was, “It’s too complicated.”

What is the alternative to professionally managed plans?

1. Jack Vogel from Vanguard suggests you fire your broker, who recommends mutual funds and buy index funds instead which are a broad mix of companies w/o all the fees. Save all the commissions and fees. (63%)

2. There is no scientific evidence showing professionally managed funds outperform basic index funds. This holds true in bull and bear markets.

3. Many fund managers own index funds in their own portfolios.

Why aren’t more of us invested in low cost index funds?

1. Fund managers spend enormous amounts of money to sell you on their ability to outperform basic index funds.

2. Brokers do their best to make you believe it is too complicated for you to invest your own money.

3. Most brokers do not sign a fiduciary agreement which require them to put your interests ahead of their own. They are loyal to the mutual funds that pay the highest commissions.

What constitutes investment advice?

1. A bill was submitted to congress requiring any financial advisor to sign a fiduciary statement which requires the adviser to always put the customer’s interest ahead of their own. The government withdrew the bill after strong lobbying from banks and investment firms.

2. Most efforts to regulate the investment industry have been unsuccessful.

3. Most retirees never planned to become wise investment shoppers till it was too late.

4. Is it the government’s responsibility to protect your investments or yours? Why health care and not investment care? How is the Affordable health care bill any different?

5. What are you going to do? Will you be able to retire?

6. What about Robert Hilton Smith’s research on the American retirement crisis? The funding for his research has dried up.