If you find it painful saving money, you’re not alone. A recent survey says 72% of Americans were stressed about money last month.

In fact, according to the Federal Reserve, 60% of Americans between the ages of 18 to 40 saved absolutely nothing in 2013. Last year, adults under 35 had a savings rate of negative 2%.

So why is this happening? Is it that hard to go to a bank and open an automatic savings or a CD account?

“The bank experience has too much friction and inertia that people are just not saving,” Ethan Bloch, founder of the personal finance app Digit, tells Business Insider.

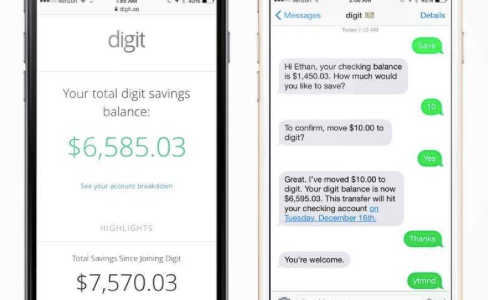

Bloch created Digit, an app that automatically saves money from your checking account without your even having to think about it. He got $2.5 million in seed funding from Baseline Ventures, Google Ventures, and a handful of other firms last December, and the app opens to the public Thursday.

The way it works is simple. Once you connect your checking account to Digit, it will automatically transfer a small portion of your money that it knows you won’t be needing immediately to a separate Digit savings account. These are FDIC-insured, custodial accounts held by Digit at two of its partner banks, Wells Fargo and BofI Federal Bank, meaning that even if Digit or both those banks go bankrupt, you will be insured up to $250,000.

The secret sauce is in Digit’s algorithm, which monitors your income and spending patterns and calculates the exact amount of money you won’t be missing.

It mainly looks at four things: the level of money in your checking account, upcoming salary, upcoming bills, and how you’ve been spending lately (with some banks, Digit can pull three years of transaction data). So if you get fired one day and your paycheck stops, Digit will see that and readjust the transfer amount. Users can always manually set their savings amount, and, if needed, withdraw their savings anytime they want, too.

But there’s a catch: Users do not earn any interest on their savings.

Digit doesn’t charge users for its service, so all the transfer and operating costs are covered by the interest Digit earns by saving those users’ money at its partner banks.

Eventually, it hopes to share some of that interest back with its users once it builds enough of a financial base. “Our goal is to share some of the interest with our customers as we grow our deposits, as long as we know we can cover our costs,” Bloch tells us.

That sharing may happen sooner than later, as the company is growing pretty well. During its five-month pilot period, which ended in December, Digit saved a total of $600,000 for its members, and now it’s saving members $1 million per month. And it hasn’t even launched to the public until this week.

If anyone can make this happen, Bloch seems to be the right guy. He was an accountant and a finance researcher before selling his own startup to DemandForce, a software company that was acquired by Intuit for over $400 million in 2012.

Read more: http://www.businessinsider.com/digit-ceo-ethan-bloch-interview-2015-2#ixzz3ZCE7XDNa